Cost basis calculator for rental property

Category one No immediate action or repair is required. The gross rent multiplier GRM approach values a rental property based on the amount of rent an investor can collect each year.

Zillow Rent Estimate Calculator Zillow Rental Manager

Were going to use a sale of 400000 on a rental property that was purchased for 340000 four years ago.

. We also offer subscription based calculators including residential cost segregation software for rental properties partial. Your home report will reveal any issues with the property on a 1-3 category basis. The basis of property you buy is usually its cost.

Some adjustments can increase your basis in an asset while others can reduce it and the latter generally is not a good thing at tax timeYou can increase your basis from there by adding the amount of money youve. Usually on a monthly basis in the form of rental payments from tenants. Increasing the basis of your rental property reduces the amount of taxable.

Rates are on a 24 hour basis Enter the market price of one gallon of fuel. Enter the total number of rental days this trip will take. Mileage Reimbursement Calculator Instructions.

Search for a state city or metro area. The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living. Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years.

When your business buys property for long-term use you can take deductions for the cost of the property by spreading it over several years using a process called depreciation. The basis of property used in a rental activity is generally its adjusted basis when you place it in service in that activity. For example if it cost you 3000 to refinance your 30-year mortgage youd be able to deduct 100 per year for the next 30 years.

The total monthly operating cost is how much it will take to operate the property on a monthly basis which includes repairs maintenance insurance and more. When the rental property is sold you have to recapture the depreciation and pay a depreciation recapture tax based on your ordinary income tax rate capped at 25. Calculating your adjusted basis in an asset begins with its original purchase price.

If you make improvements to the property increase your basis. Cost Segregation Savings Calculator. Simply adjust the sliders on the calculator below to customize the financial details.

Here are some of the most common ways to adjust the basis of your rental property. The reason is that subparagraph 40-7552aii of the ITAA 1997 allows deductions for the cost of environmental protection activities which prevent. That means the propertys adjusted cost basis is 200000 the purchase price minus the total depreciation taken.

Total Monthly Operating Costs. An ATO Interpretative Decision ATO ID 2004720 confirms that a rental property owner is entitled to claim a deduction for the cost of demolishing and removing an asbestos shed. You may also have to capitalize add to basis certain other costs related to buying or producing the property.

The original basis is the price you paid for the investment property plus any improvement. Because the new owner gets the old owners basis he or she is responsible for the tax on all the appreciation before as well as after the transfer. The cost of 975 for discount points and 164 for prepaid interest are the only two fees that can be expensed so the remaining closing costs of 5207 must be added to the original cost basis.

301 2030 CONSTRUCTION COST for G3 FLOORS. 3 Cost of Construction for 2030 3040 4060 5080 G1 G2 G3 Floors in Bangalore. Producing a home report will cost an average of between 350 and 400 for a commonly priced house of between 100000 and 200000 according to the Royal Institution of Chartered Surveyors RICS.

This is its cost or other basis when you acquired it adjusted for certain items occurring before you place it in service in the rental activity. After working on the house for several months you have it ready to rent on July 15 so you begin to advertise online and in the local papers. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange.

On April 1 Eileen bought a new dishwasher for the rental property at. Lets work through them. If the FMV when you received the gift was more than the original cost basis use.

A rental property can be a profitable real estate investment if you understand the risks involved as well as the potential return on investment ROI. Cost Basis the original value of your property or the depreciable cost. Condo Tax Basis Allocation.

You could then determine the assets depreciation recapture value by subtracting the adjusted cost basis from the assets sale price. Your deduction expenses would be 4500 per year. If you bought equipment for 30000 and the IRS assigned you a 15 deduction rate with a deduction period of four years your cost basis is 30000.

In addition as with the ownership of any equity rental properties give the investor the possibility of earning profit. The management fee is what it will cost to manage the rental if you hired a property manager or someone else to help out at the rental. But basis can also increase or decrease during the time you own the property.

Other refinance-related expenses not directly related to the mortgage may also be deductible. The original basis is your purchase price or 340000 in this case. After some time.

Our rental property calculator looks at the upfront investment costs expenses and earnings to calculate the ROI. Original cost basis for a rental property. 1 Removal of asbestos.

Free rental property calculator estimates IRR capitalization rate cash flow and other financial indicators of a rental or investment property. There are a few steps to calculating your rental property gains. The reason is that when property changes hands as a result of a divorcewhether it is the family home a portfolio of stocks or other assetsthe tax basis of the property also changes hands.

Calculate the purchase price or basis of your rental property. 2 Construction Cost in Bangalore Calculator for Cost of construction Building construction cost Residential House construction cost 2022. A Cost Segregation study dissects the construction cost or purchase price of the property that would otherwise be depreciated over 27 ½ or 39 years.

According to the Freddie Mac closing costs calculator estimated closing costs are about 6346. Heres an example. The depreciation deduction also lowered the property cost basis to 128096 which is the original cost basis of 143750 less the total depreciation expense of 15654.

You buy a rental property on May 15. Enter the daily rental vehicle rate from the State Travel Management Program website. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

Enter the total round-trip miles to be driven. The Internal Revenue Service IRS calls this type of property like vehicles machinery equipment and furniture capital assets. It is a quick and easy way to measure whether a property is worth.

The costs associated with obtaining a mortgage on rental property are amortized spread out over the life of the loan. The higher your basis the less youll pay in capital gains tax when you sell. The cost basis of stock you received as a gift gifted stock is determined by the givers original cost basis and the fair market value FMV of the stock at the time you received the gift.

Your original basis in property is adjusted increased or decreased by certain events. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses. 1 Cost of Construction in Bangalore 202122 for Building a House.

A Month To Month Rental Agreement Or Lease Agreement Is A Legally Binding Contract Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

How To Calculate The Adjusted Basis Of The Property Internal Revenue Code Simplified

How To Use Rental Property Depreciation To Your Advantage

Rental Yield Calculator

Guide To Calculating Cost Basis Novel Investor

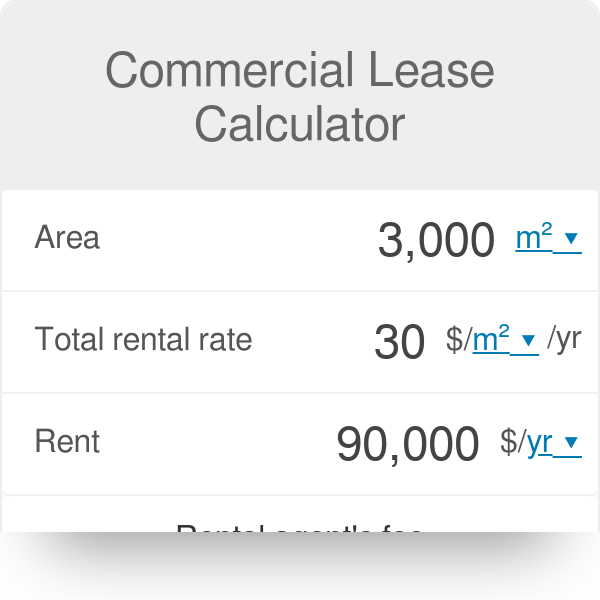

Commercial Lease Calculator

Rental Income And Expense Worksheet Propertymanagement Com

Rental Property Cash On Cash Return Calculator Invest Four More

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Property Management

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Rental Property Calculator 2022 Casaplorer

How To Calculate Rental Income The Right Way Smartmove

Rental Property Cash Flow Calculator

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate